Halibut Market to Reach USD 1.9 Billion by 2035, Driven by Rising Demand for Premium Seafood

Global halibut market growth driven by premiumization and health trends. Manufacturers are innovating to meet demand amid supply constraints.

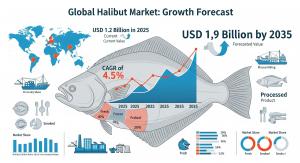

NEWARK, DE, UNITED STATES, August 5, 2025 /EINPresswire.com/ -- The global halibut market is projected to expand from USD 1.2 billion in 2025 to approximately USD 1.9 billion by 2035, growing at a CAGR of 4.5%. This steady growth, however, is set against a backdrop of increasing supply challenges, including declining wild stock and stringent catch quotas. For manufacturers, this presents a unique set of opportunities: to innovate around sustainability, traceability, and value-added processing to meet rising consumer demand while navigating a complex resource landscape.

Navigating a Changing Market: Solutions for Manufacturers

As the market evolves, manufacturers must adopt proactive strategies to secure their position and foster future growth. The provided data highlights critical areas for strategic investment.

1. Prioritize Alaska Halibut and Quality Certifications: Alaska Halibut is the dominant species, set to capture a 39.8% market share in 2025. Its popularity is driven by consistent quality, rich flavor, and large fillet yields. Crucially, its harvesting is strictly managed by NOAA and the North Pacific Fishery Management Council, which aligns with the growing demand for certified, sustainably sourced seafood. Manufacturers can leverage this by offering MSC-certified pre-portioned fillets, as practiced by processors like Trident Seafoods and Alaskan Leader. This focus on quality and certification not only attracts premium foodservice and retail clients but also builds consumer trust in a market where wild stock concerns are high.

2. Optimize for Store-Based and Restaurant Channels: The market’s distribution is highly concentrated, with store-based retail and restaurants projected to command a combined share of over 167% in 2025 (72.4% and 94.7% respectively, reflecting consumption rather than distribution exclusivity). Manufacturers should focus on these channels, which prioritize freshness and quality. For store-based retail, this means providing products with clear traceability labeling and portion-control packaging to appeal to health-conscious consumers. For the restaurant sector, which accounts for the vast majority of end-use demand, offering frozen pre-trimmed portions allows chefs to ensure standardization and yield efficiency. The increasing use of sous-vide portions in fine-casual chains demonstrates a clear path for manufacturers to supply innovative, ready-to-prepare products.

3. Embrace Technology for Traceability and Quality: In a market grappling with supply limitations and stock sustainability concerns, transparency is paramount. The data shows a strong trend toward QR-enabled traceability at the pack level, providing batch-level verification of origin. Manufacturers can differentiate themselves by implementing these technologies, as 58% of global halibut landings already come from certified fisheries. Furthermore, investing in cold-chain optimization, such as real-time temperature logging, can significantly reduce spoilage rates, a key challenge in fresh seafood logistics. For aquaculture, adopting technologies like Recirculating Aquaculture Systems (RAS) helps to stabilize supply while addressing environmental concerns.

Key Dynamics Shaping the Industry

The halibut market’s growth is shaped by two powerful dynamics: consumer demand for healthy proteins and a shift toward eco-friendly sourcing.

Nutritional Awareness and Culinary Integration: Consumers are increasingly seeking lean, high-protein food options, and halibut, with its low-fat profile and omega-3 content, fits this demand perfectly. This is driving a surge in new product formats, from skinless, portion-controlled fillets in North American retail to inclusion in meal kits in Western Europe. The 18% growth in recipe volumes featuring halibut on leading culinary platforms highlights a consumer base eager for new ways to cook this premium fish.

Sustainable Catch Controls and Aquaculture: The declining average size of wild-caught fish and low spawning biomass levels reported in recent news underscore the urgency of sustainable management. Manufacturers who partner with fisheries adhering to quota-based management and bycatch reduction protocols will have a competitive advantage. The growth of aquaculture production in Norway and Canada provides a crucial solution to stabilize supply and meet rising demand without further pressuring wild stocks.

Regional Insights and Key Players

Global growth is not uniform. Emerging markets like India (5.6% CAGR) and China (5.2% CAGR) are outpacing traditional markets. This growth is fueled by rising protein demand and an expanding consumer palate for premium, global cuisines. In contrast, while the USA (4.9% CAGR), UK (4.5%), and Norway (4.3%) continue to show steady growth, they are focused on value-added processing and product premiumization. This regional divergence presents opportunities for manufacturers to tailor their strategies, from targeting rising middle-income groups in Asia to supplying high-end, traceable products to discerning European and North American consumers.

Leading the market are vertically integrated players such as Marine Harvest, Cooke Aquaculture, and Stolt Sea Farm. These companies have established strong competitive positions through large-scale operations and robust distribution networks. Their investments in breeding programs, feed management, and land-based aquaculture capacity provide a blueprint for securing long-term supply. Meanwhile, emerging players like Clearwater Seafoods are differentiating themselves through a focus on traceable sourcing and selective breeding, proving that even with high barriers to entry, innovation can create new opportunities.

As the halibut market moves forward, success will belong to manufacturers who can strategically navigate the challenges of supply constraints by focusing on sustainability, traceability, and product innovation. By addressing these core issues, they can not only meet current demand but also secure a sustainable and profitable future.

Request Halibut Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-22440

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Explore Related Insights

Frozen Smoked Salmon Market: https://www.futuremarketinsights.com/reports/frozen-smoked-salmon-market

Tuna Peptides Market: https://www.futuremarketinsights.com/reports/tuna-peptides-market

Frozen Mackerel Market: https://www.futuremarketinsights.com/reports/frozen-mackerel-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This press release is based on a market analysis report on the global halibut market. All data and figures are sourced directly from the provided content.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.