EU Isomalt Market to Reach USD 587.4 Million by 2035 as Sugar-Free Food Adoption Surges Across Europe

EU demand for isomalt is set to rise steadily, driven by growing sugar-free and low-calorie product trends across the region.

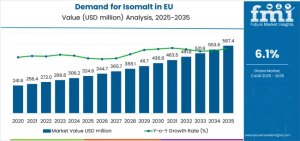

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- The European isomalt market is projected to witness substantial growth, with sales expected to rise from USD 324.9 million in 2025 to approximately USD 587.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.1%. This surge reflects an absolute increase of USD 262.3 million over the forecast period, driven by the growing consumer demand for sugar-free products, rising awareness of dental health benefits.

Between 2025 and 2030, EU isomalt demand is forecast to grow from USD 324.9 million to USD 436.8 million, accounting for 42.7% of the total decade-long growth. This initial phase is supported by accelerating sugar reduction initiatives, increasing regulatory pressure on added sugars, and consumer preference shifts toward healthier indulgence options.

The latter half of the forecast period, from 2030 to 2035, is projected to contribute USD 150.4 million in growth, reflecting 57.3% of the overall expansion. This growth will be propelled by the development of sugar-free confectionery ranges, functional foods targeting metabolic health, and pharmaceutical applications leveraging isomalt’s superior compressibility for tablet production. Increasing consumer focus on natural, clean-label ingredients further strengthens market potential.

Historical Performance

From 2020 to 2025, EU isomalt sales rose steadily at a CAGR of 4.5%, expanding from USD 260.8 million to USD 324.9 million. This growth was driven by health-conscious European consumers, rising diabetes prevalence, awareness of dental health benefits, and food manufacturer adoption for sugar reduction. Isomalt’s multifunctional properties, regulatory approval, and sugar-like characteristics have reinforced its commercial viability.

Market Drivers

The expanding EU isomalt market is supported by several key factors:

• Sugar Reduction Initiatives: Governmental regulations, sugar taxes, and voluntary industry commitments encourage manufacturers to reduce sugar content in processed foods and beverages.

• Diabetic Population Growth: Isomalt’s low glycemic index and minimal insulin response make it an ideal sugar substitute for diabetic-friendly products.

• Dental Health Awareness: Non-cariogenic properties support “tooth-friendly” marketing claims, driving adoption in confectionery and lozenge applications.

• Clean-Label Trends: Derived naturally from beet sugar, isomalt appeals to health-conscious consumers seeking natural alternatives to artificial sweeteners.

Segment Analysis

• Product Type: Powder dominates with a 70% share in 2025, offering superior handling, storage, and processing advantages, though syrup formats are gradually gaining adoption.

• Application: Confectionery leads with 42% share, followed by pharmaceuticals and bakery applications. Sugar-free candies, gums, and tablets are key growth areas.

• Distribution Channel: Direct-to-manufacturer channels account for 55% of sales, providing long-term supply agreements, technical support, and customized solutions.

• Nature: Conventional isomalt represents 62% of sales in 2025, with organic variants rising from 38% to 45% by 2035.

Country Insights

• Germany: Projected to grow from USD 137.8 million in 2025 to USD 250.9 million by 2035 (CAGR 6.5%), driven by advanced confectionery and pharmaceutical sectors.

• France: Sales expected to increase from USD 83.8 million to USD 151.9 million (CAGR 6.3%), supported by sugar-free confectionery adoption.

• Italy: Forecasted growth from USD 49.8 million to USD 90.4 million (CAGR 6.2%), driven by confectionery innovation and diabetes awareness.

• Spain & Netherlands: Growing at 5.8% and 6% CAGR respectively, reflecting expanding sugar-free product infrastructure and functional ingredient adoption.

Competitive Landscape

The EU isomalt market is concentrated among specialized ingredient manufacturers:

• BENEO GmbH: 24% share, leading in pharmaceutical-grade isomalt and European supply networks.

• Cargill Inc.: 10% share, leveraging global ingredient expertise and technical support.

• Merck KGaA: 8% share, focused on tablet applications and quality assurance.

• Wilmar BioEthanol & Baolingbao Biology: 5% and 4% shares, respectively, supporting competitive pricing and distribution.

• Other players account for 49%, highlighting opportunities in organic certification, technical support, and premium positioning.

Stay Ahead With Data-Backed Decisions. Gain Preview Access to Methodology, Sample Charts, and Key Findings by Requesting Your Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27115

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27115

Outlook

As sugar reduction trends, dental health awareness, and clean-label preferences continue to shape European consumer behavior, isomalt’s adoption across confectionery, pharmaceutical, and food manufacturing applications is poised to accelerate. With regulatory support and innovative product development, the EU isomalt market is expected to nearly double by 2035, delivering healthier indulgence options and functional benefits without compromising taste or quality.

Browse Related Insights

Isomalt Market: https://www.futuremarketinsights.com/reports/isomalt-market

Isomalt Industry Analysis in Japan: https://www.futuremarketinsights.com/reports/isomalt-industry-analysis-in-japan

Isomaltulose Market: https://www.futuremarketinsights.com/reports/isomaltulose-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.